[kudos to bnm governor! way to go bnm! let's see what najib and zahid will do to bnm governor and former bn chairman/pm/umno president with this exposure]...Zeti of BNM fights on while Ranjit of Securities Commission did not even bother

Kudos to Tan Sri Zeti Akhtar for having the gumption to do what is right pertaining the fraudulent activities executed by the unethical 1MDB management back in 2009.

In the press statement by Bank Negara Malaysiaon 9th October 2015, it was clearly said that 1MDB had supplied inaccurate information during their application to remit money overseas. This had violated the Exchange Control Act 153 (ECA).

The excerpt of the statement is as below:

The Attorney General’s decision with respect to the investigations on 1Malaysia Development Berhad (1MDB) relates to Bank Negara Malaysia’s recommendation to initiate criminal prosecution against 1MDB for breaches under the Exchange Control Act 1953 (ECA).The Bank at all times expects full and accurate disclosure of information by applicants in considering any application under the ECA.On its part, the Bank concluded that permissions required under the ECA for 1MDB’s investments abroad were obtained based on inaccurate or without complete disclosure of material information relevant to the Bank’s assessment of 1MDB’s applications.

What was the incorrect information given by 1MDB?

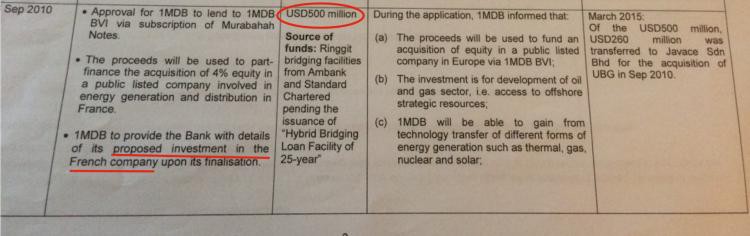

It was exposed by Sarawak Report that 1MDB had told BNM that the billions of ringgit that was to be remitted for their overseas investment is specifically for investing in a public listed company in France in September 2010.

But what happened after BNM had given their approval was nothing short of extraordinary. 1MDB went on to give loans to PetroSaudi eventhough the business joint venture was already terminated 6 months earlier.

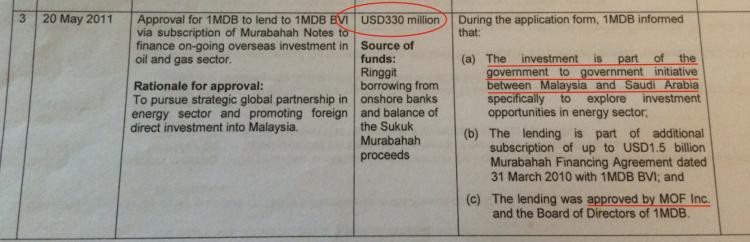

Application to remit another USD330 million was also made by 1MDB in May 2011 and BNM recorded the reason for this is to pursue foreign direct investment into Malaysia.

But did Malaysia obtain a lot of FDIs for this? We all know it did not happen. Again, 1MDB had infamously given this huge amount of money to PetroSaudi as a loan, which in the end had strangely turned into units which in the 2014 audited accounts, they were so worthless, its value had to be guaranteed by Aabar.

It’s like putting your RM1,000 into an ASB unit trust account but after some time, you can’t determine the value of your own investment, you simply had to get a third party to guarantee it!

Imagine, you need to get someone else to guarantee the value of your own money in order to lend credence to your investment. Laughable right? But that is what happened and what Arul Kanda had often smiled sheepishly about.

Of course, Bank Negara only realised this much later and in June 2015, they released a press statement that they have commenced investigations on 1MDB pertaining the cross border movement of funds exceeding RM50 million.

Rightfully, by October 2015 BNM had revoked the initial permissions granted by them and had ordered 1MDB to repatriate the USD1.83 billion to Malaysia.

The wrongdoing is crystal clear but 1MDB was not prosecuted because the Attorney General deemed that BNM was at fault in not asking further clarification! The stench of if all was overwhelming. Instead of penalising 1MDB, it was BNM who got lambasted!

The best part is, 1MDB never denied that the documents and the findings were not authentic. They are more concerned on how the documents were leaked, as if they have not done anything wrong at all.

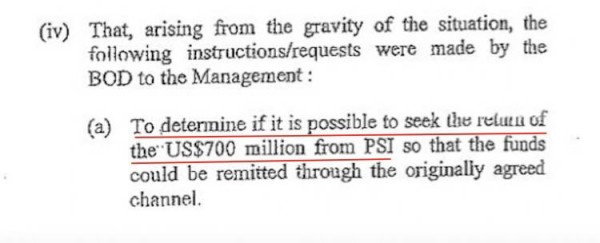

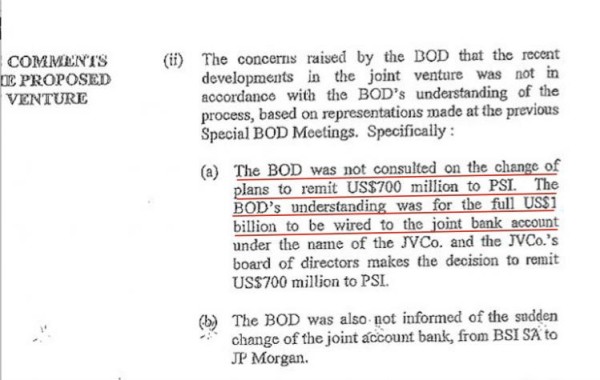

Then there was the matter of that USD700 million which went into Good Star Ltd. This huge pile of cash went into a company which even the 1MDB Board of Directors did not know of. The BOD was furious and had asked the 1MDB management to seek the return of this taxpayers money.

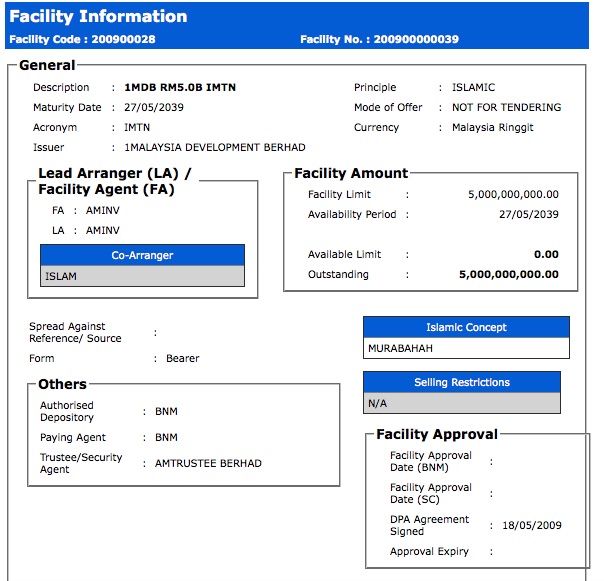

Where did 1MDB got this money? From the RM5 billion bond they have received back in May 2009. This bond was called the Islamic Medium Term Notes (IMTN) and was issued when 1MDB was known as the Terengganu Investment Authority.

1MDB’s first business venture was to have a meeting in a yacht with the owners of the then obscure company called PetroSaudi.

This IMTN bond which was fully guaranteed by the government can be categories as taxpayers money. Because in the event of a default, it is the taxpayers who had to pay for it. Since BNM had revoked the permissions, this should trigger red flag from other regulators.

One such regulator is the Securities Commission (SC).

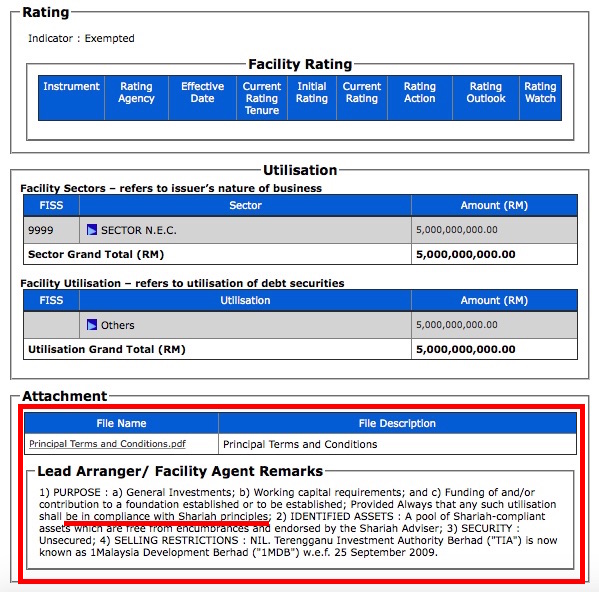

The SC is the controller of bond issuance process. And they also ensure compliance to documents when the bond was offered. Below is the term sheet for the IMTN and the purpose stated when it was issued:

Clearly shown the principal terms and condition of the loan is to be utilised in compliance to Shariah principles

Is sending money to Good Star Ltd in compliance to Shariah principles? What does Good Star do? Selling hijabs to

Plus, is putting the USD1.83 billion in Cayman Islands in compliance with Shariah principles? Are the units endorsed by a Shariah Adviser? Is the Hong Kong based Bridge Partners which ultimately managed those worthless units a Shariah compliant company? The bond is called the ISLAMIC medium term notes guaranteed by the Government, not It’s My Daddy’s Money So I Can Do Whatever I Want With It.

Many rules, act and terms were broken here yet there weren’t any noise coming out from Securities Commission. The data and goalpost have been changed unilaterally by 1MDB’s management yet the supervisory body like Securities Commission did not even make a squeak.

The latest press release by Securities Commission was about an audit partner who was charged by SC for giving misleading information when auditing a client company. They have never made any press release regarding 1MDB’s blatant misused of the bonds, nor have they commence any investigations after BNM had announced about the fraudulent dealings made by 1MDB.

Is Datuk Ranjit unaware of the situation?

Any other companies which had violated the rules by the SC will be quick to be charged. But since June (when shit hits the fan), there was no movement, no initiative taken by this supposedly infallible and highly credible institution.

Alas, only time will tell if this Malaysian regulatory body will become as wayward as the other institutions under this unscrupulous government, or maintain its high standards and integrity in the face of difficult times ahead.

A heroic woman from Bank Negara Malaysia had shown the way. We are sure it won’t be too hard for a man in Securities Commission to do a man’s job.

Source : jebatmustdie

No comments:

Post a Comment