[#NAJIBISCRACKINGUP... 1MDB EXPLAINED: A MUST READ ARTICLE] ... 1MDB: Even its experts do not know how to answer

As we sympathise with Dato Seri Husni Hanadzlah and the interview he gave last Wednesday night, we just could not believe how huge the amount of money which has been mismanaged and lost due to incompetencies and sheer arrogance.

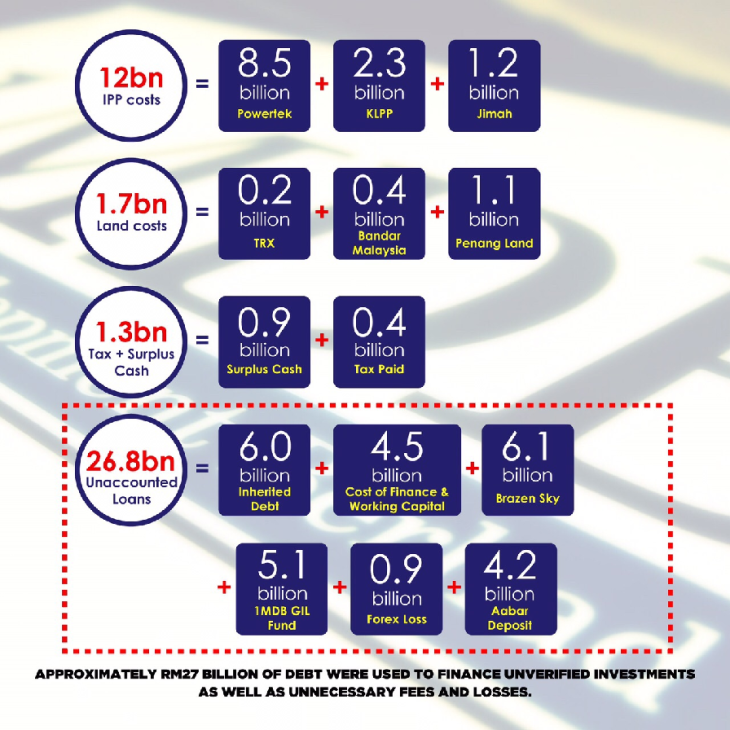

To better understand what happened to the RM42 billion debt, the diagram below, taken from Din Turtle’s blog, have rearranged Arul Kanda’s infographic into a more logical sequence.

One of the many confusion which pro-1MDB people do not seem to understand is to think that the money is all there just because they all appear in the financial accounts. All RM42 billion of them. Especially the much talked about RM27 billion.

Let’s have the simplest example:

Ali’s company borrowed RM100 from Ahmad. Ali then give that RM100 money to Ah Chong. Ah Chong then split the money he has with Abdul. So now, Ah Chong has RM50 and Abdul has RM50 to enjoy.

At the end of the financial year, if Ali’s company has not paid back the money to Ahmad, the company will have as liability, an amount of RM100 stated in its financial statement.

In Ali’s financial statements, there will be RM100. This is undeniable. But the money has gone and Ali has to find other means to pay off the loan to Ahmad.

Now that RM100 was what Arul Kanda had shown the public. It is an amount from the financial statements. Of course, he will say the money is all accounted for and has not disappeared. Undeniably, it has not disappeared from the financial statements. But where has the money gone too?

This is the question.

Some pro-1MDB buffoons we encountered even went the extra mile by claiming that all 1MDB’s ‘money’ from Cayman has been repatriated into BSI and it is there but in the form of ‘units’. Therefore, the money has not disappeared!

Question is, why in units? Why not cash? Where has the cash gone to? Did Riza Aziz buy his multi million apartment in New York using units? Can Jho Low pay his extravagant parties with units? Can Malaysians go to Haj and pay Tabung Haji using those units?

If Husni ‘units, just units’ Hanadzlah could not even answer this, definitely these random people who self appointed themselves to be the defenders of 1MDB, would not know any better.

Please do not think Malaysians are gullible enough to believe everything by just showing the financial statements. Husni’s interview could not even ascertain for sure about the amount invested in Aabar, GIL Fund and Brazen Sky. Even KPMG, the previous auditor before Deloitte had stated in the audit report:

Based on 1MDB’s latest financial documents for the year ended March 31, 2013, its auditors were unable to determine details on the US$2.3billion (RM8.05 billion) investment. – source

Hope this will clear all the befuddled minds as to why people are questioning 1MDB’s stupid business sense.

One look at the diagram above and you can see the ridiculous business model that 1MDB has been caught with.

More people are asking newer questions like:

a) Why is there a surplus cash of RM900,000,000 in liabilities? Shouldn’t cash be in assets?

b) Why should 1MDB asked for cash injection of USD1 billion from IPIC/Aabar last week when they could just withdraw the RM4.2 billion deposit with Aabar to pay off the bank?

c) Why is there still RM6 billion inherited debts? Why are they still not being paid off by 2014? Is this legacy debt from TIA back in 2009?

We are sure there are plenty more questions. And all those desperately needed to be answered by the official spokesperson of 1MDB (because its BOD, CEO and Chairman are rendered useless and brainless).

Since today is Friday, we shall venture into some light reading to jumpstart the mind. First from the Facebook of KijangMas Perkasa. This was taken without consent, lifted up from the same Din Turtle’s article stated above. Thank you KijangMas.

This is his take on the fiasco:

Since today is Yaakob Osman Day, I share his excellent down-to-earth summary of Arul Kanda’s revelations of 1MDB’s RM41.8 billion debt.

I hope we don’t have to wait another eight months for the release of the Asset side of the equation.

I’m keen to see how the DeeBee Charlatans brew reasonably believable Asset numbers as only RM13.7 bilion of the RM41.8 billion were used to acquire hard, tangible assets that could be sighted, touched, smelled and hugged by us all.

That’s RM12 billion (excluding RM6 billion legacy debts that is another can of worms) for the overpriced IPPs with mostly outdated fully depreciated assets near the end of their lopsided (and will-not-be-renewed-on-those-terms)concessions and RM1.7 billion for the three infamous land parcels in KL and Penang. The balance of RM28.1 billion of debt was used for things which at this juncture are as clear and tangible and comprehensible as flying pigs and the tooth fairy.

And I would definitely fire my CEO and especially my CFO if my Group incurs RM4.5 billion in “Cost of Finance and Working Capital”, not to mention the forex losses of RM900 million, against the real, tangible asset acquisitions of RM13.7 billion. And again, I will skin the CFO alive if he pays the Group’s “Cost of Finance”, currency losses (“Foreign Exchange Cost”) and Taxes with DEBT. Yes, with DEBT. Gali lubang kambus lubang, gali lubang kambus lubang. Guna hutang bayar bunga, bayar kerugian forex, bayar cukai. What accounting principle is this? All these should have been covered by Operating Income lah, unless the IPP revenues have also dissipated into thin air.

And c’mon lah, “Investment Cost” is an oxymoronic term. By definition, you only invest what you have. You don’t invest debt and other borrowings and then incur “cost” of your investment. Investments MUST generate returns. Investments are not cost centers; they CANNOT incur “cost” more than returns. If they do, then these are not investmentsbut borrowed money lost and pilfered via paper shuffling. And when a company needs to borrow more to service interest and for working capital — including almost one billion fresh ringgits from the Malaysian Treasury — it is in no position to “invest” anything. Whatever funds in hand — including funds raised through debt — must be available for operations. And really lah, if a company has “Investments” of RM15.4 billion, why need the almost one billion ringgit government lifeline? And why need IPIC’s RM3.7 billion injection that I’m sure was secured at a very high price to ultimately the nation?

Now, simple question. The RM15.4 billion “Investments” in Brazen Sky, Aabar Investment Deposits and Global Investment Limited Funds generate what kind of returns? 5%? 7%? 10%? What? Enough to cover fees and interest costs of borrowing those funds? Again, what convoluted financial logic entails borrowing money at a purported 10-20% p.a. all-in costs for the purpose of “Investments” in fuzzy undefined paper assets and units of dog’s balls or something with undetermined and questionable returns? And where are these returns thus far? Not enough to service the debts?

Hence needing almost a fresh one billion ringgit of tax payers’ money? What’s the redemption/liquidation value of these “Investments” today? Again, how can a company “invest” debt? Mana ada logic? Is this the modus operandi of 1MDB? Borrow at Ah Long terms and try to make money in a crapshoot? Oh, and the Malaysian government inexplicably guarantees this Ah Long debts? What really is the Strategic Value of the RM15.4 billion “investments” in the three entities that justifies a sovereign guarantee for the borrowed money? Otherwise we all will starve or get conquered by some enemy state? What Strategic Value?

Semua ini ada masuk akal ka?

As I commented in YO’s post:-

” Good of Arul to lay the big numbers on the table and now he should be well-equipped to clarify and quantify the multiple embedded line items not yet disclosed or detected as we collectively dissect the details and financial logic of the various transactions.”

And since we are all constrained by a lack of detailed data beyond the top line numbers, I added:-

“The same info/data/context limitation applies to all.

That’s why I’m amused by those who are cocksure of the positive rationale and practicality of these multifarious financial engineering tapdance based just on fuzzy bits of incoherent numbers . . . although these Jacks cannot reconcile their “everything’s fine & dandy” stance with the multiple audits and investigations of this enterprise by many entities across all genres, not to mention my old buddy Husni’s admission of inherent grave debt-servicing problems.

Where we stand now, based on the chunks of data without the granularity of line item Sources and Application of funds,we can only ask more questions, seek more details of the blobs of debts and “investments” quantified in billions upon billions of fuzziness.

Your (YO’s) summary is as far as we can go based on current publicly disclosed info. And the revelations have raised more questions than answers. What we all DON’T NEED is the hysterics of the Jib Gor Jacks who tumble head over heels to rationalize complex derivative-flavored transactions wayyy over their heads andhandicapped by their utter ignorance of the intricacies of cross-border financial dynamics and equipped only by these chunks and blobs of top level numbers.

To these Jacks, like almost everyone else, you know Jack Schitt about these numbers. So just STFU and go pursue some other pastime.”

And this applies to Rafizi and Tony Pua as well. Shut up. Just shut up. Don’t turn this into a partisan political circus.This is a matter of national interest perhaps unprecedented in our corporate history. Your partisan barkings will just give Jib Gor the lifeline among the gullible fools within UMNO to not cleansed themselves from within. In effect, you buffoons are now Jib Gor’s Talian Hayat. So just STFU and stand aside as the ominous fallout from this scandalous outrage descends on the culprits.

We think this is a clear enough point of view for people to understand.

Next is from Syed Outside The Box’s article:

- Husni warns if 1MDB debt not resolved, negative events impact economy

- 1MDB downgrade credit outlook, plunge in value of ringgit

- if Putrajaya forced to shoulder RM42b on top of dev. expenditure RM52b

- govt fail to meet targeted deficit of 3.2% and revert to over 4%

- ratings will drop, currency will drop like in 1998,.. how to pay debts?

- must solve issue of debt so people do not have to worry,” he said

- Putrajaya accountable for RM11.1b loan secured using letter of support

- Moody’s said govt support of 1MDB jeopardise sovereign credit rating

- chain of negative effects if 1MDB’s debt passed to govt

- Husni stressed in same interview no money yet been lost by 1MDB

- banking sector first to chase firm ..to avoid non-performing loans

- “financial sector is quiet, means issue of money lost not there”

My comments : Who asked you to incur so much debt idiot?

And if 1MDB is such a great investment, if it is so profitable, then why worry about 1MDB not being able to pay its debts?Just use the billions of profits that 1MDB is making and settle all the debts. Why complain that if 1MDB debts are not paid then Malaysians will all suffer? Why put the burden on the people? Husni Hanadzlah should just resign. Najib should resign as well.

In 1998 the entire Asian region was hit by the money speculators particularly George Soros. Thailand was hit before us, also South Korea and Indonesia. They all suffered from the Asian Contagion.

This time the other Asian economies are much stronger and robust. The Phillipine economy is racing ahead, the strongest economy in ASEAN.

Only Malaysia is facing bankruptcy because the Advisor to 1MDB has been conned by a 29 year old Chinese boy.

RM42 Billion of taxpayers money has disappeared. RM27 Billion has literally gone out the window.

RM2.6 Billion was paid to Jho Low for nothing. That was stolen money.

The remaining RM15 Billion has been used to buy end of shelf life and “license almost expired” power plants at exhorbitant prices – way above market value. That money is also almost as good as gone.

In 1998 the country’s economy was strong. Despite the Asian Financial Crisis the government had enough money to pay all its debts. Our credit ratings were never downgraded by Moody’s or by anyone else.

We recovered well and went on to record 7%, 8% and even 9% growth. Now we can barely get past 5% growth.

This is not the fault of the Malaysian people. This is the fault of the clueless morons who are our prime minister and the members of the Cabinet. Including Husni Hanadzlah.

These people must be held accountable for this gross incompetence, dishonesty and stupidity.

Lastly, this is a comment from Syed’s reader:

Anonymous said…

Anonymous said…

This power point is no financial statement I have ever seen where debt = “asset” + “liabilities” (eg. Inherited debt?) + “expenses” (+ eg. Brazen sky? Tax paid?) + “losses” (eg. forex). I have no idea what the f*ck financials is this.

1. It shows DEBT = All 1mdb finances. So does 1mdb operate only on debt money ie. Cash hutang from bank. 1mdb tak dak income ka?

2. When you purchase companies you assume their hutang. That is fair n normal. But you do not pay-off those companies debt; the companies pay them from their operating cashflow. Unless you are stupid. Question: did 1mdb pay off the companies 6 billion hutang using 1mdb loan?

3. Cost of finances is 4.5 B. Over 5 years of 1mdb. That’s almost 1B per year. That is usually finance expenses + interests. You pay that using positive operating cashflow not from another source of debt (1mdb loan). If loan is being used to pay loan then the assets bought are non viable. So scratch all assets on line 1 and 2. Useless. Business live and die on cashflow. After 5 years if still living on debt then the entity is not a going concern. Conclusion: 1mdb is bankrupt

4. Tax Paid = 400 million. Simple question. Has 1mdb remitted that payment to Tax Department. �� I doubt it.Kalau cash remitted to bank in spore pun all of sudden turn into “units” whatever fuck that means I doubt it lah. But anyway – confirm la tax dept please

5. All those 15.4 billion investment/deposits. That means those are still liquid cash held by these entities for whatever reason but are all due to 1mdb, or are they just like those “units” in spore or some other form of burnt cash. Please detail what, where, and verified documentation where the moneys are. We want those money back NOW. If not, why not.

Thursday, June 04, 2015 2:21:00 PM

Thank you and try to have a fine and dandy Friday!

More readings:

Source : jebatmustdie